What Exactly is Mirrorly?

Mirrorly is a copytrading platform that allows users to automatically mirror the trades of other traders. You can choose from our Mirrorly exclusive traders or from a list of our very own curated traders featured on the Binance and Hyperliquid leaderboards, with more exchanges to come.

Currently, Mirrorly executes trades on Bybit, BloFin,Bitget and Hyperliquid, offering users the ability to copy trades using their own trade sizing ratios and set Stop-Loss/Take-Profit parameters with near-instant execution.

If you are a trader and wish to trade privately for friends and family, or publicly for others, you can apply to become a Mirrorly Trader here.

Mirrorly is free to use when you sign up through our referral links for

Bybit, BloFin, or Bitget.

We also support Hyperliquid — which operates via a builder fee model starting at 0.07%, instead of using referrals.

Both Hyperliquid and BloFin require no KYC, making them ideal for users who prefer quick onboarding and privacy-first setups.

Mirrorly currently does not accept direct payments, but you can join our payment waitlist to be notified when subscription plans go live.

If you’re a long-time trader or used copytraders before you might find this section too basic. Feel free to skip ahead to the next section on preparing for launch or just trying out yourself, but it’s also not a bad idea to make sure there’s nothing in here that surprises you. Let’s do this.

This article covers:

- Setting up a Mirrorly Account

- Generating & Setting API keys

- Creating Copytrader

- Analzying & Adding Traders

- Advanced Copytrading Features

Becoming a Mirrorly user

Mirrorly is free to use when you sign up through our referral links for

Bybit, BloFin, or Bitget.

We also support Hyperliquid — which operates via a builder fee model instead of using referrals.

Already have a Bybit account? No worries.

If you already have a Bybit account, you have a few options:

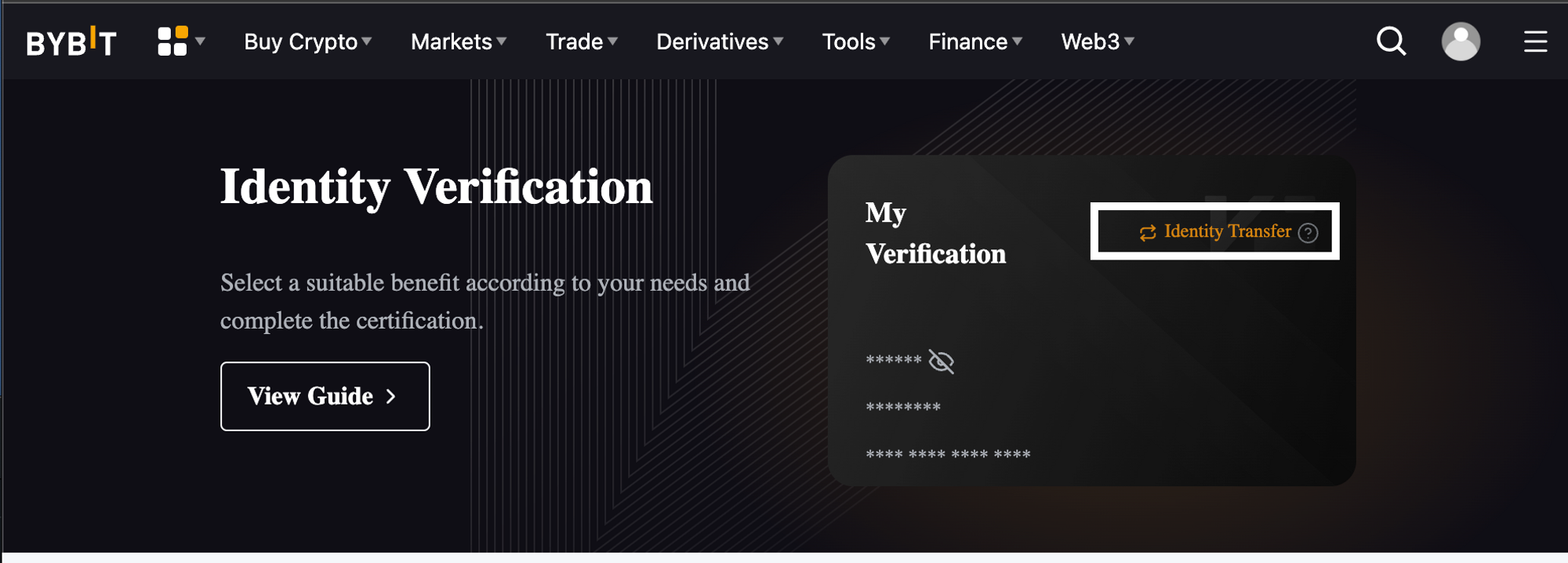

- If your account was signed up using a different referral link, you can register a new account using Mirrorly's referral link and request Bybit for an Identify Transfer of KYC to your new account. (Note that users can only request Identity Transfer once every 6 months) This is the quickest route, you have autonomy over this option and the entire process only takes a few minutes

If your account was signed up in the last 14 days you can request for Affiliate Transfer by opening a support ticket in Bybit.

Use one of our other supported exchanges:

- BloFin — referral-based access, no KYC required.

- Bitget — referral-based access.

- Hyperliquid — operates via builder fee tiers (starting at 0.07%) and requires no KYC.

Welcome to Mirrorly! 😊

Before you dive into copytrading, here are a few tips and rules to help you get started:

Use a separate subaccount: You must use a separate subaccount for Mirrorly and avoid running any other trades in parallel. Failing to do so may risk copytrading mistakes and could put your account at risk of liquidation.

Start small: We recommend following no more than one trader at a time when you’re just getting familiar with the platform. This will help you understand the product and how trades are executed.

Stay updated on the go: Connect to our Telegram bot to receive real-time trade updates and get the status of your positions while you're on the move.

Setting trade ratios: If the balance of the trader you want to copy is unknown, use their historical trading data to determine your trade ratio. For example, if the trader’s median max trade size is $10K, and you want to limit yourself to $1K, set your ratio to 10%.

Understand leverage: We use cross leverage, and all our settings values are notional. We recommend not leveraging up unless you fully understand the product dynamics. With cross leverage, if you have a balance of $10,000 in your account and set the Max Limit Account Size at $20,000, you are effectively leveraged 2x. A 50% drawdown would wipe out your entire account.

Get the latest updates: Join our Discord community,Telegram channel or follow our Twitter profile for updates, trade recommendations, and more

Setting up a Mirrorly Account

The first step is setting up your Mirrorly account. Our process is straightforward, simple, and designed with respect for your privacy and autonomy.

We offer two authentication options:

Web3 Authentication: You can use a digital wallet, such as MetaMask, to get started. No need to deposit any funds into this wallet; it simply serves as your access key to Mirrorly. If you're new to digital wallets, we've got you covered with a comprehensive guide here that will walk you through the process of creating and using one.

If you register with a wallet (Web3 authentication), a sign request will appear. By accepting this request, you confirm ownership of the wallet and grant Mirrorly permission to use it solely for authentication purposes.

Web2 Authentication: Prefer a more traditional signup method? You can also create an account using your email address or connect with your Google account. This method offers a familiar and simple way to get started.

Creating Your First Copytrader

On the Mirrorly platform, navigate to the Copytraders tab or click on "Create New" from the Home tab to create your first Copytrader.

Name Your Copytrader: The first step is to choose a name for your Copytrader. This helps you easily track and manage the traders you're copying.

Set Up API Keys: Once you've named your Copytrader, you'll need to create a set of API keys specifically for use with Mirrorly. Select your exchange of choice and enter the API keys.

Generating & Setting API Keys

Mirrorly provides support for: Bybit,Hyperliquid,BloFin and Bitget exchanges.

Important: When setting up your API keys, make sure to create a seperate subaccount. specifically for Mirrorly. Running other trades in parallel or manually adjusting Mirrorly positions (increasing or decreasing) may cause copytrading issues and could risk your account being liquidated. To ensure optimal performance and safety, only Mirrorly should manage your copytrading subaccount.

Choose the exchange you'll be using, and follow the instructions below to generate and set up your API keys:

If you're already familiar with the process of creating API keys, you can proceed directly to the next section: Creating Copytrader & Configuring Trading Parameters

Configuring Trading Params

After creating your API keys and setting up a copy trader, it's time to configure the trading parameters and select traders to follow.

Our trading parameters are divided into 3 sections

- Opening Behavior - to define the logic for opening trades

- Increase Behavior - to manage cases once a trade has already been opened

- Closing Behavior - to handle risk and profit-taking

Opening Behaviour

- Opening Size: Select between Fixed Value & Ratio To Trader (For more info refer to: Understanding Position & Opening Size)

- Ratio To Trader: input a % to determine your position relative to the trader's open position. For example, selecting 25% would mean an open position of $2,500 when the trader opens a $10,000 position.

- Fixed Value: input an initial position size that will apply to every trade OPEN.

- Initial Size in USD: Set an initial size to be used for all new trades in the copytrader (Only applicable when Fixed Value is selected).

- Slippage %: Slippage is the price difference between the trader you're copying and the actual price when your order is executed. By setting a slippage percentage, you control how much price variation you’re willing to accept. For example, if you set 1% slippage, your position will only be opened or increased if the price difference is within 1%. If the price deviates beyond that, the trade will not be executed.

- Limit Account Size (USD): set a maximum USD value that your copytrader can hold. For instance, if your account limit is set at $1000 and you currently have open positions worth $1000, your copytrader will not open new positions.

- Maximum Position Size (USD): set a maximum USD amount for a single position per trader in your copytrading portfolio.

- Maximum Symbol Size (USD): set a cap on the total USD amount that can be allocated to a specific symbol, regardless of how many traders are trading that symbol in your copytrading portfolio.

- Auto Adjust Leverage: Activate automatic leverage adjustments to prevent risk limitations imposed by your exchange on certain symbols. Please be aware that enabling this feature may lead to significantly higher margin requirements and escalate the risk of liquidation.

Remember, Mirrorly uses cross leverage, so your actual leverage depends on the ratio between your Max Account Limit and the funds in your account. For example, if you have $100 in your account and set a Max Account Limit of $200, your effective leverage is 2x

Increase Behaviour

- Maximum Number of Increases: Enter the maximum number of increases to copy. After reaching this number, no more increases will occur.

- Maximum Increases Size (%): Enter the maximum increase percentage to copy (for more information, refer to "Increase Size by %" in our FAQ).

Closing Behaviour

- Basic Stop Loss %: Set a percentage as stop-loss protection, which will apply per position.

- Take Profit Orders: Establish your own take-profit logic using our Basic or Advanced profit features.

After configuring your trading parameters, you are now ready to add some traders to copy!

Analyzing & Adding Traders to Copytrader

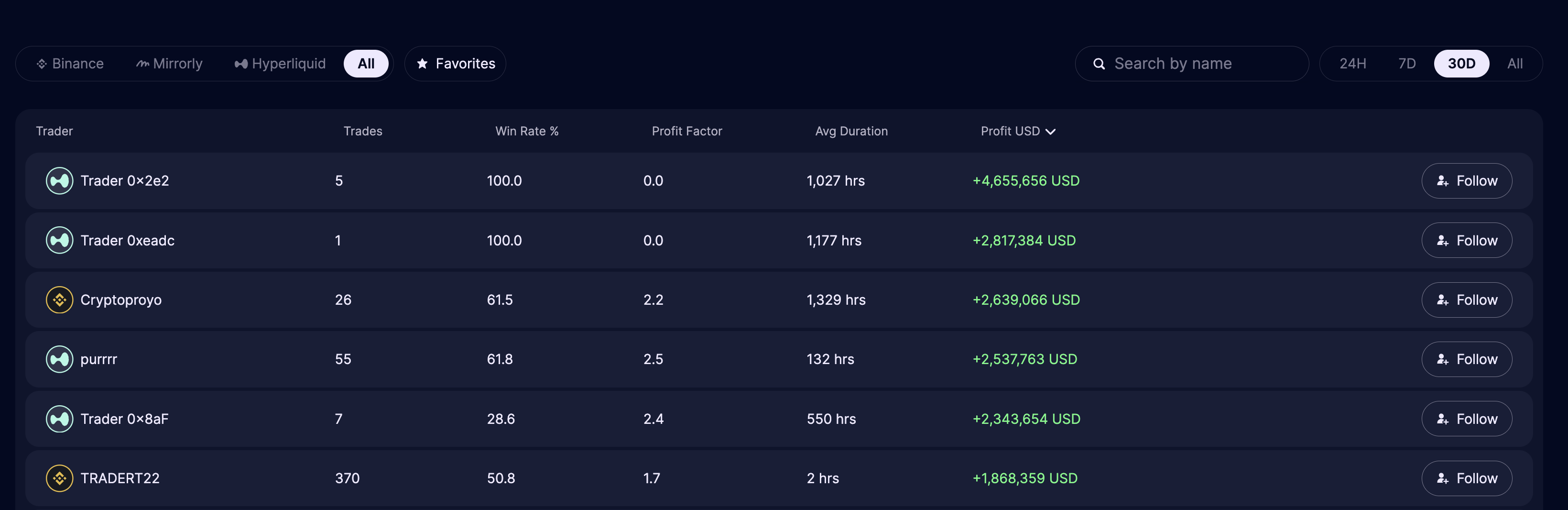

Once you've set up the API keys for trading and configured your trading parameters and logic, it's time to select traders to copy! Begin by navigating to the "Leaders" tab, where you'll find a list of our currently supported traders along with key metrics. Our current metrics include:

- Profit in the last 24 hours / 7 days / 30 days / total

- Win Rate % - The percentage of winning trades out of the total number of trades made by the trader. A higher win rate indicates a more successful trader, but it's essential to consider this metric alongside other factors, such as profit factor, to get a complete picture of a trader's performance.

- Profit Factor - A measure of a trader's effectiveness, calculated by dividing the total profit of their winning trades by the total loss of their losing trades. A profit factor greater than 1 indicates a profitable trader, while a value less than 1 suggests a losing trader. The higher the profit factor, the better the trader's performance.

- Avg Duration - Average time a trader spends in a trade

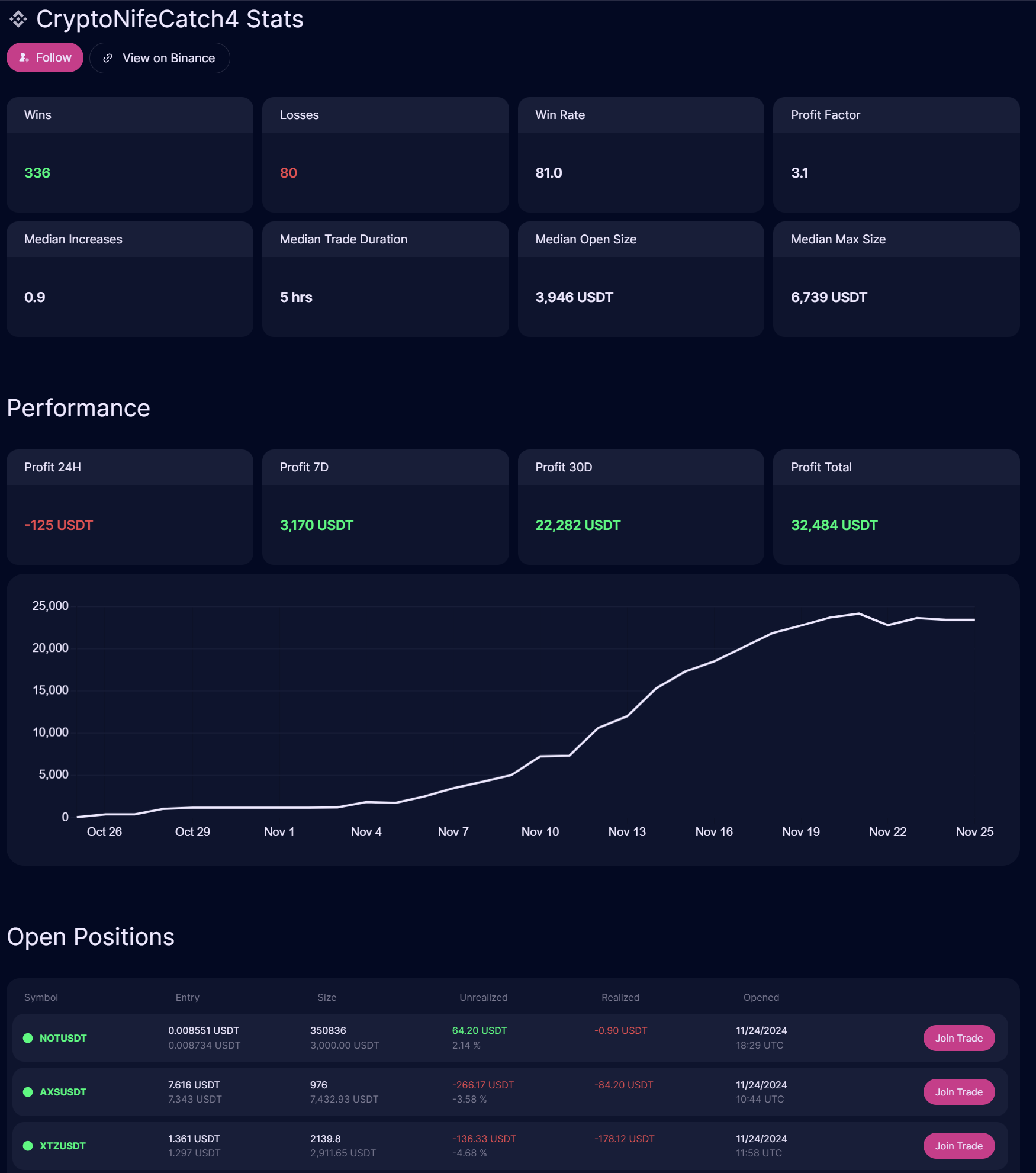

Use this information to identify traders you want to copy, and click on their names for additional details, such as:

- The number of trades, wins, and losses

- The average number of increases per trade, which can help you determine sizing for individual traders

- Current open and closed positions, so you can better understand the trader's behavior and know what to expect

After analyzing this data, note the names of the traders you want to copy, return to your copytrader, and select "Add Trader.”

A window will appear displaying a list of available traders to copy. Find the traders you decided to add based on your analysis and click "Add."

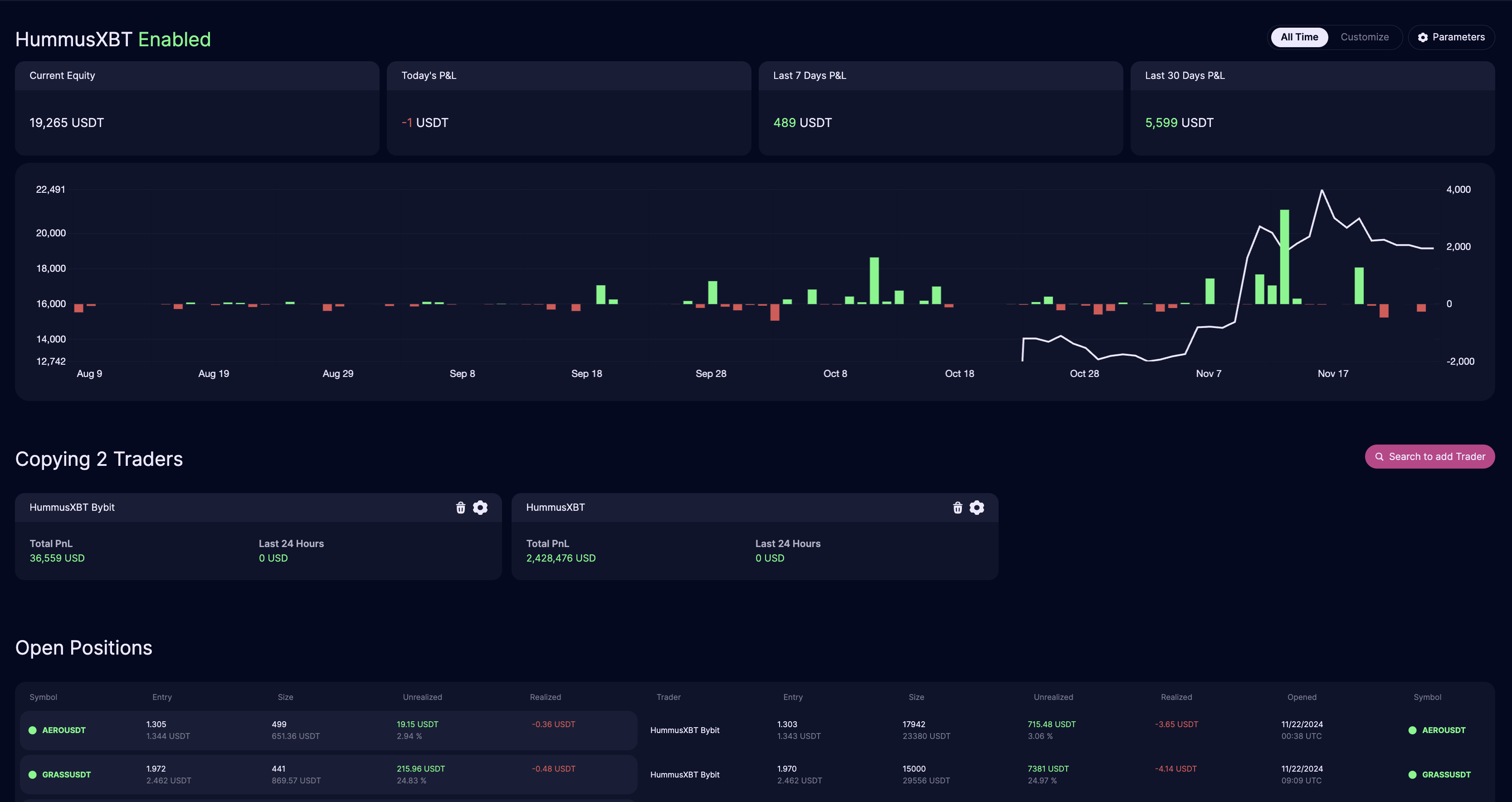

Upon closing the window, your copytrader screen will update to show the traders you are now following. If they have any open positions, those will be displayed without copying your position size, as shown in the screenshot below (the right side shows the copytrader position, while the left side shows our position, which is empty).

You're all set to start trading! To begin copytrading with the traders you've added and the trading configuration you've set, simply click "Enable Trader" under "Status" and wait for a position to open.

Advanced Copytrading Features

Mirrorly offers several powerful features to enhance your copytrading experience, providing more flexibility and control over your trades. Below are three advanced features to help you maximize your copytrading strategy:

Join Trade

With Join Trade, you can join an existing trade from a trader you are copying, even if you missed the original entry. This feature also allows you to join the trades of any trader on the platform, even if you aren't regularly following them.

When you join a trade, Mirrorly will automatically copy all future increases, decreases, and closures for that position. However, it’s important to note that you will enter at the current market price, which may differ from the trader’s original entry.

The Join Trade button will appear next to any open trades that you aren't currently involved in. When clicked, you’ll be prompted to choose between fixed size or ratio-based sizing for your position.

Trader Specific Params

Mirrorly allows for granular control over your copytrading setup by enabling Trader Specific Params. This feature lets you customize parameters for each individual trader within a copytrader, making it easier to manage different strategies under the same copytrader.

To set specific parameters for a trader, click the Settings button next to their name within your copytrader. These settings will override the general copytrader settings for that particular trader.

Inverse Copytrading

For users looking for a more unconventional strategy, Mirrorly offers Inverse Copytrading. This feature allows you to mirror the actions of a trader in the opposite direction. For example, if the trader opens a long position, your account will automatically open a short position.

This strategy carries more risk since it relies on the assumption that the trader’s decisions will result in losses. Inverse Copytrading is configurable within Trader Specific Params, allowing you to enable it on a per-trader basis.